[ad_1]

The value of a large number of digital currencies has expanded this year. As the end of 2021 approaches, the market value of all more than 11,000 encrypted assets is approximately US$2.6 trillion. Nowadays, it can be said with certainty that tokens pegged to the US dollar (also known as stablecoins) occupy an important position in the crypto market. Today, the market value of all stablecoins in the world exceeds $152 billion, accounting for 5.84% of the dollar value of the crypto economy.

Stablecoins have seen huge growth in the crypto economy

Stablecoins have always been a hot topic in the cryptocurrency world, because these U.S. dollar-pegged tokens have experienced significant growth in 2021. Basically, a stable currency is a cryptocurrency that uses an external reference value such as the U.S. dollar or other legal currencies.

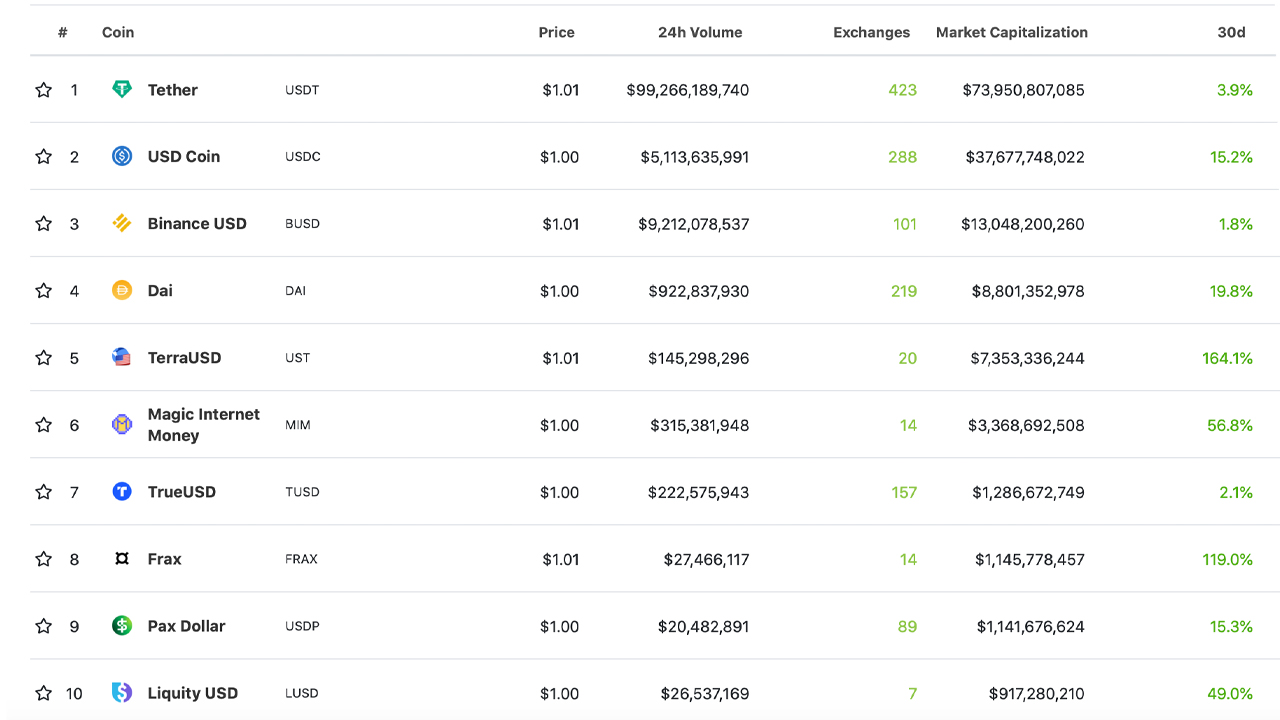

In terms of market capitalization, the largest stablecoin today is Tether (USDT), because its current market valuation is US$73.95 billion. In the past 30 days, USDTThe market value of the company has risen by 3.9%. The second largest stablecoin by market value is the U.S. dollar (USDC), with a value of 37.6 billion U.S. dollars, an increase of 15.2% within 30 days.

2 USD-linked tokens account for 73% of the stablecoin economy, and stablecoin trading pairs dominate

Although the stablecoin market is valued at US$152 billion, USDT USDC and USDC together account for 111.55 billion U.S. dollars or 73.38% of the stablecoin economy.Although the market value of USDC has risen by more than USDTYes, this is not the largest increase in the top ten stablecoin rankings last month. The market capitalization of the stablecoin terra usd (UST) increased by 164.1%, while the market value of frax (FRAX) increased by 119%. The stablecoin Magic Internet Currency (MIM) skyrocketed 56.8%, and the liquid dollar (LUSD) rose 49%.

The existence of stablecoins is very strong. In the past 24 hours, the volume of stablecoin transactions exceeded 50% of the global transaction volume of the crypto economy. Bitcoin (Bitcoin) The market itself shows the tether (USDT) Represents 52.63% Bitcoin Today’s swaps and a stablecoin called BUSD issued by Binance control 7.05% BitcoinTransaction volume. USDC is the seventh largest trading pair Bitcoin And account for 1.75% of all Bitcoin Swap.

Ethereum (Ethereum) The market is not much different USDT It accounts for 45.11% of today’s Ether trading pairs. BUSD accounts for 9.60% of the total Bitcoin The swap and USDC order on Friday was 1.68%.Whether the crypto market is bearish or bullish, stablecoins like it USDT, BUSD and USDC have been Bitcoin‘sand EthereumTop trading pairs in 2021, as well as legal currencies such as the U.S. dollar, Japanese yen and euro. This is also true for the vast majority of top tokens in the crypto economy, as stablecoin pairs now represent the majority of transactions.

What do you think of the ever-expanding stable currency economy? Please tell us your thoughts on this topic in the comments section below.

Image Source: Shutterstock, Pixabay, Wiki Commons, Coingecko,

Disclaimer: This article is for reference only. It is not a direct offer or invitation to buy or sell, nor is it a recommendation or endorsement of any product, service or company. Bitcoin Network Does not provide investment, tax, legal or accounting advice. The company or the author is not directly or indirectly responsible for any damage or loss caused or claimed to be caused by using or relying on any content, goods or services mentioned in this article.

[ad_2]

Source link